Why should companies know ESG criteria?

In recent years we have witnessed a growing concern of society for different aspects related to sustainable development. As it could not be otherwise, this interest has also been reflected in the business world, to the point that sustainable investment in Spain grew by 36% in 2019, as reflected in the 2020 study by Spainsif.

But what exactly do we mean when we talk about sustainable investing?

Commonly known as socially responsible investments (SRI), it is a type of investment that, in addition to financial analysis, considers compliance with ESG (Environmental, Social and Governance) criteria. These types of factors are increasingly used when financing a business.

A bit of history about corporate sustainability

In itself, the concepts of sustainable or ethical investments or criteria are nothing new. Already in the 90s, the progress of sustainable investment was a fact and it was decided to launch the Dow Jones Sustainability Index, the first global index that introduces sustainability criteria. Soon after, the United Nations (UN) took a big step forward with the implementation of the Principles for Responsible Investment.

In recent years we have witnessed different legislative initiatives at European and state level aimed at promoting sustainability in companies, such as the Non-Financial Reporting Act, the definition of the Taxonomy sustainable of the EU, (where activities that contribute to the mitigation and adaptation to climate change are classified) or the development of the well-known “green bonds” for the financing of environmental projects.

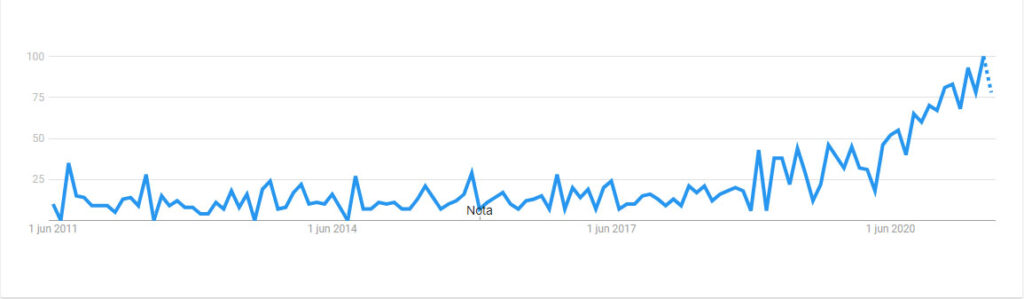

It is therefore not surprising that the search volume for the acronym ESG has skyrocketed in recent years.

*EsG term search volume in Spain (Google Trends)

Knowing ESG criteria

Within this current framework where society demands a more sustainable, lasting and ethical development; a scenario, in addition, which is under the growing protection of European legislation and regulations, companies have decided to incorporate into their business strategy, various environmental, social and good corporate governance factors.

It takes into account issues such as climate and climate change transition risks, scarcity of natural resources, pollution and waste, energy consumption, environmental assessment of suppliers’ products and services and management of environmental indicators, as well as environmental opportunities and other relevant issues.

It includes issues such as work factors, family reconciliation, equality within the company, good business environment, working conditions and risk prevention, talent retention, cybersecurity and information security, including the protection of personal data of the interested parties.

It includes elements related to Corporate Governance and the behavior and transparency of the company, such as the quality and effectiveness of the governing body, internal controls and the definition of responsibilities and authorities, risk management, audit criteria and the necessary policies, guidelines and codes established by senior management.

Benefits of an ESG Strategy

In the first place and as we have seen throughout the article, these aspects seem to have come to stay so it is expected that organizations that care about the environment, that are socially responsible and have good Corporate Governance, will benefit in the future (more if possible) by European and Spanish regulation. Without going any further since the end of 2020 from Europe began the development of a new proposal on Sustainable Corporate Governance. A review of the Non-Financial Reporting Directive and the approval in Spain of a new Law on the Prevention of Money Laundering are also expected. Finally, on May 20, Law 7/2021, of May 20, on climate change and energy transition in Spain, was approved.

Also as has been seen in recent years, a mismanagement of some of these sustainability factors from organizations, can have a media impact that can have a dramatic impact on the image of the company, more taking into account the role of social networks in the brand image.

Finally, we must not forget that companies are ultimately run and managed by people, and many of them have a growing concern about issues such as climate change or family reconciliation and aspire to create and maintain an ethical and sustainable company.

How can we help you?

Historically GlobalSuite Solutions has had extensive experience in ESG-related projects, such as environmental projects (ISO 14001 and carbon footprint); crime prevention, anti-bribery and compliance (based on ISO 19601, ISO 37001 and ISO 37301, respectively); related to the Non-Financial Information Law, projects in the field of Information Security and Data Protection, Business Continuity and Crisis Management, Risk Management, etc. This experience has allowed us to design a global project for the compliance of companies with respect to the main ESG requirements, addressing in an integrated way the three pillars of business sustainability, taking advantage of all the functionalities and advantages of our GlobalSUITE® management tool.