In an increasingly complex and competitive business world, risk management has become a key component for the success and sustainability of any organization. The International Organization for Standardization (ISO) provides a framework for effective and efficient risk management in all types of organizations. In this article, we will explore what the ISO 31000 standard is, its purpose, and how it can benefit your company.

What is the ISO 31000 standard?

The ISO 31000 standard is a set of international guidelines and principles that provide a systematic and structured approach to the identification, assessment, treatment, and monitoring of risks in any organization. The standard was first published in 2009, and its latest update was carried out in 2018. Its main objective is to help organizations protect their assets, achieve their objectives, and improve decision-making.

The structure and components of ISO 31000

The ISO 31000 standard is based on three main components: principles, framework, and risk management process. These components are interconnected and reinforce each other to provide a coherent and effective approach to risk management.

Principles

The standard establishes 8 principles that should be followed by any organization seeking to implement a risk management system based on ISO 31000. These principles are:

- Integration: Risk management should be integrated at all levels of the organization and in all processes.

- Structured: Risk management should have a structured approach in the organization’s governance.

- Personalization: Risk management should be tailored to the specific needs and characteristics of each organization.

- Inclusion: All relevant stakeholders must participate in the risk management process.

- Dynamism: Risk management should be proactive and capable of adapting to changes in the internal and external environment.

- Continual improvement: The organization should constantly seek opportunities to enhance its risk management approach.

- Evidence-based: Decision-making in risk management should be based on accurate and up-to-date information.

- Human and cultural factors: Human behavior and culture influence risk management.

Risk management framework

ISO 31000 establishes a framework aimed at helping organizations integrate risk management into all their activities and core functions. To achieve this, the support and commitment of stakeholders, especially top management, are essential. The development of the framework involves integrating, designing, implementing, evaluating, and continuously improving risk management throughout the organization.

- Leadership and commitment from top management are crucial to aligning risk management with the objectives, strategy, and culture of the organization. Also, appropriate authority and responsibility must be assigned at different levels of the organization. Oversight committees are responsible for overseeing risk management and ensuring that risks are considered when establishing the organization’s objectives.

- The integration of risk management depends on understanding the structures and context of the organization. Governance and management structures translate strategic guidance into concrete actions to achieve sustainable performance. All members of the organization have the responsibility to manage risk.

- The design of the framework involves understanding the organization’s internal and external context, establishing commitment to risk management, assigning roles and responsibilities, allocating adequate resources, and establishing effective communication and consultation with stakeholders.

- The successful implementation of the framework requires a proper plan, identifying decision-makers, and modifying relevant processes. Periodic performance assessment and continuous improvement are essential to ensure the effectiveness and adequacy of the framework.

- The organization should continuously adapt and improve the risk management framework based on internal and external changes, identifying gaps and improvement opportunities, and assigning responsibilities for its implementation. tunidades de mejora, y asignando responsabilidades para su implementación.

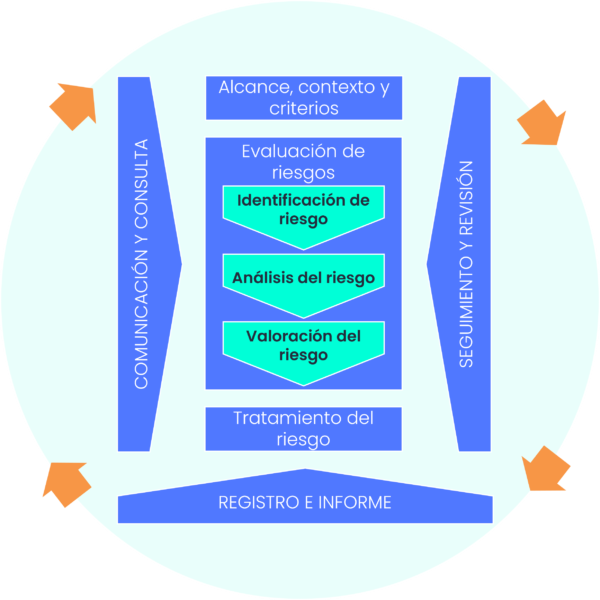

Risk management process

The ISO 31000 standard describes a risk management process that consists of several stages:

General:

- Establishing the framework and principles for risk management in the organization.

- Defining the roles and responsibilities of the parties involved in the risk management process.

Communication and consultation:

- Establishing a communication and consultation approach to support risk management.

- Sharing relevant information with stakeholders and gathering their feedback.

- Ensuring that communication and consultation are timely and effective.

Scope, context, and criteria.

- Defining the scope of the risk management process, including the limits and boundaries of its application.

- Understanding the internal and external context of the organization, including environmental, cultural, legal, financial, among other factors.

- Establishing the criteria for evaluating and comparing risks.

Risk assessment:

- Identifying the relevant risks for the organization.

- Assessing the probability of the risks occurring and their potential impact.

- Analyzing the interrelation between risks and their potential accumulation.

- Prioritizing the risks based on their importance and establishing the basis for informed decision-making.

Risk treatment:

- Developing and implementing strategies and actions to address the identified risks.

- Selecting the most suitable options to address the risks, which may include avoiding, transferring, mitigating, or accepting the risks.

- Establishing controls and measures to reduce the probability of risks occurring and minimize their impact.

- Continuously monitoring and reviewing risk treatment strategies to ensure their effectiveness.

Monitoring and review.

- Establishing a continuous monitoring process to oversee the implementation of risk management strategies.

- Periodically evaluating the performance of the risk management process and its effectiveness in relation to established objectives.

- Conducting regular reviews to adapt and improve the risk management process based on internal and external changes.

Registration and reporting:

- Maintaining proper records of identified risks, actions taken, and outcomes obtained.

- Generating reports on the status of risks and risk management activities to inform stakeholders.

- Communicating the results of the risk management process and any relevant changes to stakeholders in a clear and effective manner.

It is important to highlight that the risk management process is iterative and continuous, adapting according to the organization’s needs and context, with the aim of constantly improving the ability to identify, assess, and effectively treat risks.

Benefits of implementing ISO 31000 standard

The adoption of the ISO 31000 standard can provide organizations with a range of benefits, including:

- Improved decision-making: Risk management based on ISO 31000 helps organizations make informed and data-driven decisions, leading to more effective and predictable outcomes.

- Protection of assets and reputation: By proactively and systematically managing risks, organizations can protect their assets, resources, and reputation from potential losses or damages.

- Regulatory compliance: Adopting ISO 31000 can facilitate compliance with applicable legal and regulatory requirements by providing a structured and coherent approach to risk management.

- Competitiveness and growth: Organizations that effectively manage their risks can seize opportunities and tackle challenges more efficiently, enabling them to be more competitive and sustainable in the market.

Why implement the ISO 31000 standard with software?

The implementation of the ISO 31000 standard using a specialized solution not only optimizes risk management in your organization, but it can also drive the success and growth of your business. Here are some reasons to adopt risk management software in the implementation of the ISO 31000 standard:

- Automation of the risk management process: Specialized risk management software can automate many tasks that would otherwise be manual, such as data collection, risk assessment, and report generation.

- Increased efficiency and productivity: Automation allows processes to be more efficient and faster, reducing the time and resources required to manage risks.

- Increased confidence in decision-making: Risk management software centralizes information and provides updated and consistent data, enabling leaders to make informed and confident decisions that drive the success and sustainability of the company.

- Improved reputation and brand image: Utilizing a risk management solution demonstrates your company’s commitment to excellence and regulatory compliance to customers, partners, and regulators. This strengthens the reputation and brand image of your business.

- Collaboration and synergies: Implementing the ISO 31000 standard with software facilitates communication and collaboration between departments, promoting a team approach to risk management and generating synergies that can improve organizational efficiency and effectiveness.

- Integration with other systems: Risk management software can easily integrate with other systems, such as project management or quality management systems, enabling a more integrated and comprehensive management of risks.

In summary, implementing the ISO 31000 standard with software can significantly improve the efficiency and effectiveness of risk management, which can have a positive impact on decision-making and the achievement of organizational objectives.

Do you want to save time and effort in implementing the ISO 31000 standard? Try GlobalSuite Solutions software and enjoy simpler and more effective risk management. Request a free demo today!